50 years ago there were no trading platforms at all. People would go to a broker to arrange the purchase of securities, stocks, or bonds. A few years later, it was enough to call the broker on the phone and specify the stock and quantity of shares to become a co-owner of the business. Financial reports of the companies were received by mail, and dividends could only be obtained by going to the office.

To invest in 2023 means to open an application on your phone and press the “Buy” button. Nothing else is needed to be a full-fledged investor. All records of purchases and sales are stored online, and your portfolio is accessible to you from anywhere in the world and is in your pocket. In this article you will learn how much does it cost to build a trading platform and what will you need before creating it.

How does a broker work in a mobile trading platform?

Brokers have become portable, so there’s no need to go to the office or call them anymore. Imagine that you’re opening a list of NASDAQ stocks and there are hundreds of options to choose from. Millions of users around the world are ready to buy or sell each of these stocks. To simplify the entire buying and selling process, the broker acts as an intermediary for you. The broker stands in the middle between you and the seller: when you click “Buy”, the broker starts looking for suitable options at the right price, then purchases the stock with your money and transfers it to your account. All of this happens in seconds, and you don’t even realise that you were helped with the purchase of the stock. The same process applies to selling shares.

Without a broker licence, you won’t be able to upload your application to the App Store or Google Play. As a broker, you will be responsible for the security of clients’ accounts, reporting on their portfolios, and issuing tax statements. Before creating a trading platform, be sure to obtain a licence in all countries where you plan to conduct business!

What features should the application have?

The primary focus of a trading platform should be on simplicity and user-friendliness. Consider the user’s journey from the app’s main page to purchasing or selling securities and ensure that every button is conveniently located and visually appealing.

Charts

Every trading platform should offer two types of charts: linear and Japanese candlesticks. The linear chart is easy to use and shows price movement, making it helpful for beginners. The Japanese candlestick chart is a must-have for advanced traders and investors, as it provides more detailed information than the linear chart. Brokers that offer an abundance of information, including Japanese candlesticks, will satisfy their clients.

Analytical Data

In addition to charts, a trading application should always include statistical data such as revenue, profit, and profitability. Investors require solid reasons to buy or sell securities, so providing this kind of information is essential for any modern trading platform.

Orders

Modern platforms offer a variety of orders for buying and selling securities, which is an essential tool for investors. Market orders, stop orders, and limit orders are just a few examples. Stop orders can automatically sell a security when it falls to the level specified by the investor, helping to save them from unnecessary losses. Including such orders will be highly valued by your target audience, making it crucial to provide them to your customers!

In addition to the aforementioned trading methods, consider the importance of design. Intuitive and straightforward design is important for modern application development. Simplification is a trend in app design that can increase user engagement. Consider adding features such as filtering and sorting functions, allowing investors to find the securities they need quickly. Implementing tools that encourage customers to spend more time in your application is also key. Consider adding a “News” section to keep investors up to date on important events, which will enable them to apply this knowledge immediately to their trades.

How to earn money on a trading app?

There are several ways to monetize a trading platform. Before creating an app, choose one of the following methods:

Commission on securities deals. This is one of the most common ways to earn revenue. Usually, account maintenance is free, but customers pay a percentage of the amount of each trade. You can also further develop this method by adding different pricing tiers, such as a “Free” tier without paid maintenance and a commission of 0.6% per transaction, and a “Trading” tier with a $5 monthly maintenance fee and a commission of 0.2% per transaction.

Brokerage account maintenance fee. You have the option to waive the commission and instead make a monthly payment for account maintenance. However, before making this decision, it’s important to carefully consider the advantages and disadvantages. While a maintenance fee may seem more convenient, keep in mind that with commission, you stand to earn significantly more.

Premium subscriptions. Some brokers offer premium subscriptions that can provide a range of additional services. These may include access to a personal manager who can assist clients in creating their portfolios and provide expert advice on any questions or concerns they may have.

Market leaders

E*Trade is a leading brokerage firm and a subsidiary of Morgan Stanley, one of the largest banks in the United States. Since 1982, the company has been providing brokerage services, and it generates revenue from interest on margin trading (trading with the broker’s funds), commissions on trades, and portfolio management services.

Robinhood is the embodiment of a young and daring investor. Since its inception in 2013, the company has amassed over 16 million clients. Its revenue streams include offering information on market orders, margin lending, and earning interest on client’s uninvested cash. The last point is somewhat akin to account maintenance fees.

Stash – Stash is a popular choice for novice investors, offering free educational courses, a user-friendly app design, and personalised strategies based on a client survey. The company’s revenue is generated from account maintenance fees.

How much does it cost to create a trading platform?

Throughout the article, we emphasised the importance of simple and user-friendly design. This is the key to success and business development in the world of stock market and cryptocurrency. Finance is a complex topic, especially for newcomers. Therefore, your main task is to make the application easy to understand and navigate. Before creating the application, dedicate as much time as possible to UX/UI design of your trading platform, and profits won’t keep you waiting.

To ensure a fast and high-quality app development process, consider companies like React Native that create apps for both Android and iOS simultaneously. With a unified codebase, they can create one application for two distinct operating systems, saving time and money.

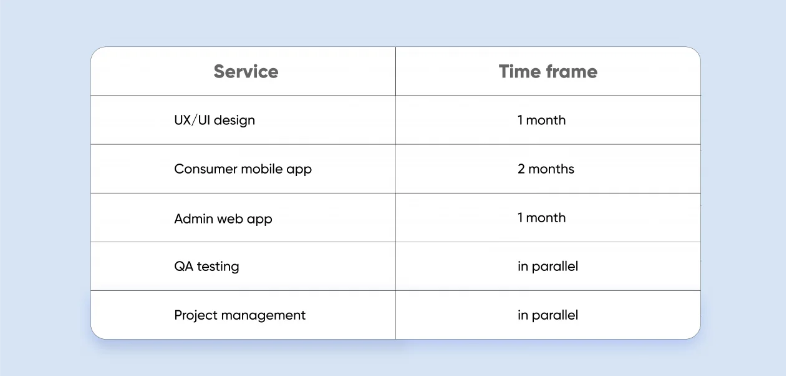

A team of 6 people will work on your trading platform. Based on our practical experience, we estimate the development cost to be around $75,000 to $85,000. This cost includes:

• Full application development cycle;

• UX/UI design;

• Creating prototypes and testing;

• Developing applications for Android and iOS.

As a gift, you’ll receive a consultation with experts who will answer all your questions and share tips and secrets on how to create a quality trading application.